When Fat Cats Bet on Fat Tails

UPDATE 9:30am get me rewrite! Readers ask for more clarity on what my point is, so a little added rewriting. There has been a lot of passionate moral debate about US income inequality (Greg Mankiw recently got a torrent of abuse for the horrific sin of admitting that he was a rich person). But you have to UNDERSTAND income inequality before you CONDEMN it. By the end of this post, I'll suggest a different angle.

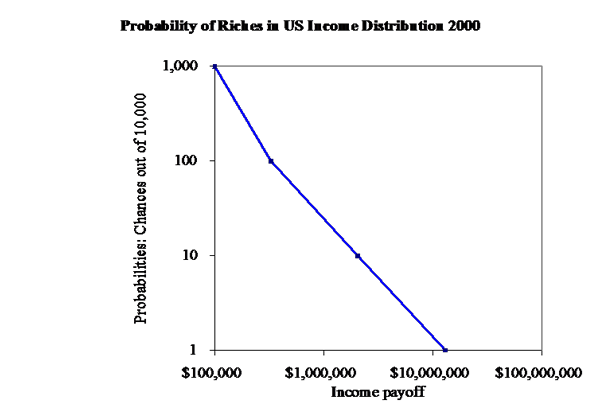

So what if we step back from the moral judgments and just try to describe the upper echelons of US riches. Figure 1 below shows the likelihood of each level of income in the US income distribution, using the same logarithmic graph which was greeted with total incomprehension wild enthusiasm in a previous post.

In this graph, the vertical axis shows your chances out of 10,000 in reaching the income level shown on the horizontal axis, assuming very stupidly that you are typical of the entire American population. 1 out of every 10,000 Americans clears on average more than $10 million a year (the data are from the great and famous paper by Piketty and Saez). Every movement on either axis multiplies by 10. So 10 out of 10,000 (or 1 out of a 1000) have to settle for being only millionaires instead of deca-millionaires. 1000 out 10,000 (or one out of 10) clear a measly $100,000 a year. (Since the line in Figure 1 is almost straight, we could say the upper limits of the income distribution fit a Power Law, which as mentioned in the previous post is a special type of fat-tailed distribution that many people (at least three) find fascinating.)

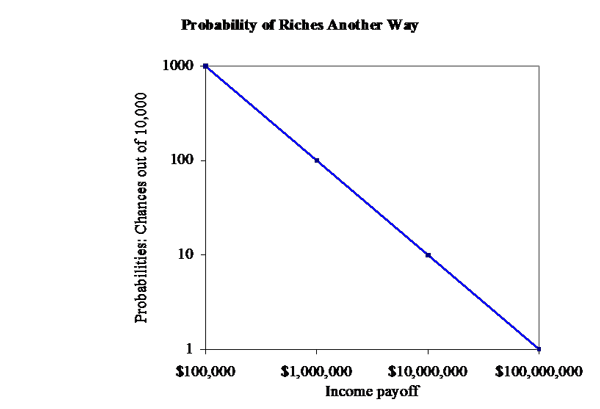

Figure 2 shows an alternative way of becoming rich at great odds. This is an exact power law with a slope of -1, meaning that if your chances get 10 times worse, you get 10 times the payoff if you succeed.

We call this alternative income-generating-process “Las Vegas.” The line shows the payoff if you bet $10,000 at the odds shown. Ignoring the tiny detail that the house takes its cut, betting a fixed amount at longer and longer odds follows an exact Power Law.

So is getting rich in America just a matter of making a big bet at very long odds? It’s not the worse metaphor ever – an awful lot of things all have to go right for somebody to become very rich, so the odds are indeed long. A lot of economic outcomes follow Power Laws – the sizes of firms, the sizes of cities, the export value of different exported goods, the cumulative growth of nations, etc. – for similar reasons.

So what if one of the contributing factors to income inequality is just that finding your own personal VERY BIG HIT is rare? This is equivalent to the usual description of income inequality as a very small proportion of the population having a VERY LARGE INCOME. Moreover, by comparing Figure 1 and Figure 2, you can see the payoff from the "bet" in figure 1 is not large enough to be a "fair bet" in the sense of fully compensating for the very long odds. (Mischievous Question to provoke discussion: does this mean the income distribution is unfair to the rich?) And furthermore the rest of us want somebody to take on the very long odds of finding a VERY BIG HIT, like the movies Titanic and Avatar, or the iPhone and iPad, because the very big payoff reflects how valuable the Big Hit is to consumers.

So (as @dillardsarah on Twitter suggested as a summary of this post) could inequality just be big, valuable, unlikely bets paying off?

Of course, not everyone faces the same betting odds in the American income distribution, which is when the passionate moral debate kicks back in.

From Aid to Equality

From Aid to Equality